PortfoliosPortfolios

Excepteur sint occaecat cupidatat non proident, sunt in coulpa qui official modeserunt mollit anim id est laborum 20 years experience.

Personal Loan

PortfoliosPersonal Loan

Your Financial Freedom, Just One Click Away

Up to ₹1 Crore | No Collateral | Low Interest Rates | Fast Approvals | Doorstep Assistance

Key Features of LoanSetu Personal Loans

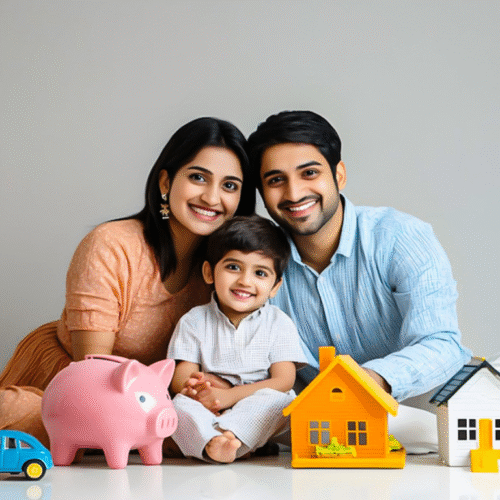

Life is full of unexpected expenses—and exciting opportunities. Whether you’re planning a wedding, managing medical bills, renovating your home, or pursuing higher education, a Personal Loan from LoanSetu India offers quick, collateral-free funding with flexible repayment terms.

- No Collateral Required

- Quick and Easy Process

- Competitive Interest Rates

- Customizable Repayment Plans

- Affordable EMIs

- Convenient Service at Your Doorstep

.

We Provide

Personal Loan For

Wedding Fund

Medical Fund

Education Fund

Check

03

Balance Fund

Restructure Fund

Free Consultation

Frequently Asked Questions

What is a personal loan?

It’s an unsecured loan used for personal expenses—no collateral required.

Who is eligible?

Salaried professionals, self-employed individuals, and business owners with a stable income and good credit score.

What are the interest rates?

Rates start from 10.25%, varying based on profile and lender.

How fast can I get the loan?

Once documents are submitted, approvals can happen within 24–72 hours

How much can I borrow?

You can get up to ₹1 Crore, depending on your income and credit history.

Do I need to specify the purpose of the loan?

No. Personal loans offer full end-use flexibility.

.

What’s the maximum loan tenure?

Up to 7 years, with custom repayment plans available.

.

Is the process fully digital?

Yes. You can apply online, upload documents digitally, and get approved without visiting a branch.

.

Careers

Want to Be Part of

Our Team?

Home Loan

PortfoliosHome Loan

Turn Your Dream into reality with Loan Setu India

Up to ₹1 Crore | Flexible Tenure up to 30 Years| Loan up to ₹20 Cr | Transparent Process | Doorstep Assistance

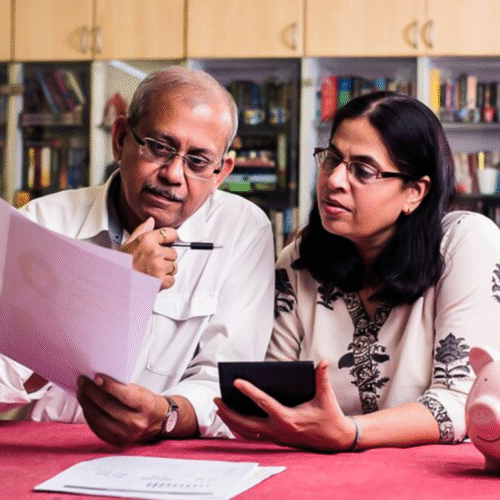

What is a Home Loan?

A Home Loan is a secured loan that allows individuals to finance the purchase, construction, or renovation of a residential property. It is repaid in monthly installments (EMIs) over a flexible tenure and can include fixed or floating interest rates.

Whether you’re buying your first house, renovating your current space, or building an extension for your growing family, LoanSetu India offers smart and flexible Home Loan solutions that fit your life goals.

With access to 55+ leading banks and NBFCs, we make it easier than ever to secure the home loan that’s just right for you—with minimal documentation, fast approvals, and zero stress.

.

Home Loan Features

|

Feature |

Details |

|

Loan Amount |

Up to ₹20 Crore |

|

Interest Rate |

Starting @8.20% p.a. |

|

Loan Tenure |

Up to 30 Years |

|

EMI Example |

₹748 per ₹1 Lakh (Approx.) |

|

Collateral |

Property to be mortgaged |

|

Processing Time |

Fast approval & quick disbursal |

|

Top-Up Loan |

Up to ₹50 Lakhs |

|

Part-Prepayment & Foreclosure |

Available without heavy charges |

|

Balance Transfer |

Save more by transferring your existing loan |

|

PMAY (Pradhan Mantri Awas Yojana) |

Subsidy benefits available |

We Provide

Home Loan For

Buy Home

Renovate Home

Extend Home

Check

03

Plot Purchase

Empower Women

Free Consultation

Frequently Asked Questions

What is a home loan and how does it work?

A home loan is a secured loan provided by banks or financial institutions to help individuals buy, build, renovate, or extend a home. The loan is repaid over a fixed tenure in monthly EMIs, and the property acts as collateral until the loan is fully repaid.

How much loan amount can I get through LoanSetu India?

LoanSetu India can help you secure a home loan of up to ₹20 Crores, depending on your income, credit score, and property value.

What are the interest rates?

Home loan interest rates typically start at 8.20% per annum, and can vary depending on the lender, applicant profile, and loan amount.

What is a top-up loan?

A top-up loan is an additional loan amount you can borrow over your existing home loan for any personal or business need—without fresh collateral.

What is the maximum tenure for repayment?

You can choose a repayment period of up to 30 years, which helps you keep EMIs affordable and suited to your income.

Is there any benefit under government housing schemes?

Yes, eligible applicants can benefit from Pradhan Mantri Awas Yojana (PMAY) which offers interest subsidies for first-time homebuyers under specific income categories.

.

Can I transfer my existing home loan to LoanSetu India’s partner banks?

Absolutely. We offer home loan balance transfer facilities to help you switch to a lender offering a lower interest rate or better terms.

Is prepayment or foreclosure allowed?

Yes. LoanSetu India works with lenders who allow part-prepayment and full foreclosure, often without any penalty, especially for floating-rate home loans.

Apply Loan Now — Get Instant

Approval

Business Loan

PortfoliosBusiness Loan

Power your Business Growth with Loan Setu India

Flexible Repayment Options| Maximum Loan Amount |Minimal Documentation| Quick Disbursal

What is a Business Loan?

A Business Loan is a financial tool designed to help entrepreneurs and business owners meet working capital needs, expand operations, buy equipment, manage inventory, or launch a new startup.

LoanSetu India makes this process simple by offering loans with:

- ✔️ Quick Approvals

- ✔️ Minimal Documentation

- ✔️ Low Processing Fees

- ✔️ Fixed Interest Rates

- ✔️ Doorstep Assistance

Business Loan Features

|

Feature |

Details |

|

Loan Amount |

₹50,000 to ₹1 Crore |

|

Interest Rate |

Starting @15% (Fixed) |

|

Repayment Tenure |

Up to 5 Years |

|

Processing Time |

Quick Approval & Disbursal |

|

Documentation |

Minimal & Simple |

|

Top-Up Loans |

Up to ₹50 Lakhs Available |

|

Balance Transfer |

Reduce EMI with our transfer plan |

.

We Provide

Business Loan For

Expand Business

Working Capital

New Startup

Check

03

Machinery Finance

Cash Flow

Free Consultation

Frequently Asked Questions

What’s the interest rate applicable on business loans?

Interest rates start from 15% per annum and may vary depending on the lender and your credit profile.

Do I need to provide collateral for a business loan?

We offer both secured and unsecured business loans. Unsecured loans don’t require collateral but depend heavily on creditworthiness.

What are the interest rates?

Home loan interest rates typically start at 8.20% per annum, and can vary depending on the lender, applicant profile, and loan amount.

What is the tenure of a business loan?

Loan tenure ranges from 12 months to 30 years, depending on the type of loan and bank policy.

Can I transfer my existing business loan to LoanSetu India for a better deal?

Absolutely. You can opt for Balance Transfer and enjoy lower interest rates and better terms.

How many banks can I compare through LoanSetu India?

We work with 35+ banks and NBFCs. Based on your profile, we shortlist and offer you the 3 best options.

What is the maximum tenure for repayment?

You can choose a repayment period of up to 30 years, which helps you keep EMIs affordable and suited to your income.

How soon can I get the loan amount disbursed?

Once documents are submitted and verified, loans are typically disbursed within 3 to 7 working days.

.

Can I transfer my existing home loan to LoanSetu India’s partner banks?

Absolutely. We offer home loan balance transfer facilities to help you switch to a lender offering a lower interest rate or better terms.

Can startups apply for a business loan?

Yes, startups with a registered business and valid business plan are eligible for funding, subject to lender criteria.

Is there a processing fee involved?

Yes, banks or NBFCs may charge a nominal processing fee, but we ensure it is minimal and disclosed upfront.

Do you charge any service fees for loan assistance?

No. Our services are completely free for customers. We don’t charge for consultation or doorstep services.

Apply Loan Now — Get Instant

Approval

Loan Against Property

PortfoliosLoan Against Property

Unlock the True Potential of your property

Loan Amount up to ₹25 Crores | Low Interest Starting @ 8.50% | Tenure up to 25 Years | Zero Prepayment Charges | Doorstep Service

Get Big Funds, Backed by Your Property

Need a large loan for business expansion, medical emergencies, weddings, or higher education? A Loan Against Property (LAP) from LoanSetu India helps you raise high-value funds by leveraging the value of your residential or commercial property—without selling it.

This secured loan offers the freedom to use funds for any purpose, along with affordable EMIs, flexible tenure, and maximum loan amounts tailored to your needs.

Loan Against Property Features

- High loan amounts tailored to your needs

- End-use flexibility: weddings, education, business, medical, or personal

- Lowest EMIs with long tenure options

- Instant eligibility check & quick disbursal

- Safe and secure processing

- Personalised offers with multiple lender comparisons

We Provide

Loan Against Property For

Wedding Funding

Medical Support

Education Finance

Check

03

Home Upgrade

Business Boost

Free Consultation

Frequently Asked Questions

What is a Loan Against Property (LAP)?

It’s a secured loan where you pledge residential or commercial property as collateral to raise funds for personal or business needs.

Do I need to provide collateral for a business loan?

We offer both secured and unsecured business loans. Unsecured loans don’t require collateral but depend heavily on creditworthiness.

What’s the tenure for repayment?

You can choose a repayment period of up to 25 years.

Can I apply if I’m self-employed?

Absolutely. Both salaried and self-employed individuals are eligible.

Do I need to transfer the property’s ownership?

No. You retain ownership. The property is only used as collateral.

Can I use the loan amount for any purpose?

Yes. LAP offers complete end-use flexibility—business, personal, education, medical, etc.

How much loan can I get?

Loan amounts range from ₹5 Lakhs to ₹25 Crores, depending on your property’s value and income profile.

How soon can I get the loan amount disbursed?

Once documents are submitted and verified, loans are typically disbursed within 3 to 7 working days.

.

What are the interest rates?

Rates start at just 8.50%, depending on your credit score and property type.

Is there any prepayment or foreclosure charge?

No, part-prepayment is completely free with most of our lending partners.

How soon can I get the loan?

With complete documents, you can get approval and disbursal in as little as 7–10 working days.

What types of properties are accepted?

You can pledge residential, commercial, or even rented properties—subject to legal and valuation checks.

Apply Loan Now — Get Instant

Approval

Working Capital Loan

PortfoliosWorking Capital Loan

Power your Business with Reliable capital

Secured Loan | Low Interest Rates | High Loan Value | Export Financing | Transparent Process

Keep Your Business Running Smoothly

Running a business means managing constant cash flow needs. Whether it’s purchasing raw materials, paying staff, or funding daily operations, Working Capital Loans from LoanSetu India provide the financial support you need—when you need it.

Our secured, property-backed working capital loans offer flexible usage, attractive interest rates, and funding up to 150% of your property’s market value—designed to help your business grow, scale, and operate without interruption.

Working Loan Capital Features

- Secured Funding with High Loan Value

- Lowest Market Interest Rates – Repo or LIBOR Linked

- Minimal Documentation

- Support for Export-Oriented Businesses

- Short- and Long-Term Capital Options

Expert Advisory and - End-to-End Support

We Provide

Working Capital Loan For

Raw Purchase

Staff Wages

Sales Boost

Check

03

Production Fund

Order Finance

Free Consultation

Frequently Asked Questions

What is a Working Capital Loan?

It’s a loan designed to help businesses manage everyday operational expenses such as payroll, inventory, and marketing.

How much loan can I get?

You can get funding up to 150% of the market value of your pledged property, subject to eligibility.

Who is eligible for a working capital loan?

MSMEs, startups, exporters, and established businesses with valid documentation and property ownership.

Can I apply online?

Absolutely. Fill out the LoanSetu enquiry form, and our team will handle the rest.

Can I transfer my existing business loan to LoanSetu India for a better deal?

Absolutely. You can opt for Balance Transfer and enjoy lower interest rates and better terms.

How many banks can I compare through LoanSetu India?

We work with 35+ banks and NBFCs. Based on your profile, we shortlist and offer you the 3 best options.

Is this loan secured or unsecured?

You can choose a repayment period of up to 30 years, which helps you keep EMIs affordable and suited to your income.

What is the interest rate?

Rates are linked to the RBI repo rate and start at just 8.5%.

.

Can I use the funds for export financing?

Yes, we offer export financing at LIBOR-based rates and support for forex transactions.

Can startups apply for a business loan?

Yes, startups with a registered business and valid business plan are eligible for funding, subject to lender criteria.

Is there a processing fee involved?

Yes, banks or NBFCs may charge a nominal processing fee, but we ensure it is minimal and disclosed upfront.

Do you charge any service fees for loan assistance?

No. Our services are completely free for customers. We don’t charge for consultation or doorstep services.

Apply Loan Now — Get Instant

Approval

Vehicle Loan

PortfoliosVehicle Loan

Low Interest Rate | Fast Approval Growth| Up to 100% Financing

Flexible Repayment Options| Maximum Loan Amount |Minimal Documentation| Doorstep Assistance

What is a Vehicle Loan?

A Vehicle Loan is a financing solution that helps you purchase a new or pre-owned car, two-wheeler, or commercial vehicle. The loan is repaid in EMIs over a flexible tenure with attractive interest rates. You don’t have to worry about paying the entire vehicle cost upfront—LoanSetu India covers up to 100% of the on-road price.

Whether it’s a sleek new car, a dependable bike, or a powerful commercial vehicle—LoanSetu India is here to fuel your journey with easy and affordable Vehicle Loans. With our wide network of 35+ trusted banks and NBFCs, we bring you the best loan offers to match your budget, lifestyle, and repayment ability.

Vehicle Loan Features

|

Loan Amount |

₹50,000 to ₹1 Crore |

|

Interest Rate |

Starting @ 8.5% p.a. |

|

Loan Tenure |

Up to 7 Years |

|

Financing |

Up to 100% for select vehicles |

|

Approval Time |

As quick as 24–48 hours |

|

Used Vehicle Loans |

Available for eligible cars and bikes |

|

Prepayment/Foreclosure |

Option available with minimal charges |

We Provide

Vehicle Loan For

New Car Loan

Used Car Loan

Two -Wheeler

Check

03

Commercial Vehicle

Heavy Duty

Free Consultation

Frequently Asked Questions

What is a vehicle loan?

A vehicle loan is a type of financing that helps you purchase a new or used car, two-wheeler, or commercial vehicle. You borrow a specific amount and repay it through monthly EMIs over a fixed tenure.

How much loan amount can I get?

Loan amounts range from ₹50,000 to ₹1 Crore, depending on the vehicle type, your eligibility, and the lender’s policies.

What is the interest rate for vehicle loans?

Interest rates typically start from 8.5% per annum and vary based on the applicant’s profile, loan amount, vehicle type, and the lender.

Can I apply for a vehicle loan if I’m self-employed?

Yes! Both salaried and self-employed individuals are eligible to apply. You just need to provide the relevant documents (like ITRs or business proof).

Can I prepay or foreclose my vehicle loan early?

Yes, most lenders allow part-prepayment or full foreclosure of the loan. Some may charge a small fee, depending on the terms.

What types of vehicles can I finance through LoanSetu India?

You can get financing for:

New Cars

Used/Pre-owned Cars

Two-Wheelers (bikes/scooters)

Commercial Vehicles like trucks, vans, or tempos

Can I get 100% financing on a vehicle loan?

Once documents are submitted and verified, loans are typically disbursed within 3 to 7 working days.

.

How long can I take to repay the vehicle loan?

Loan tenures can go up to 7 years, giving you flexibility to choose an EMI amount that fits your monthly budget.

What documents are required for a vehicle loan?

For most applicants, the basic documents include:

PAN & Aadhaar card

Bank statements (last 6–12 months)

Salary slips or ITRs

Vehicle quotation or invoice

Our advisors will help you with everything.

Why should I apply for a vehicle loan through LoanSetu India?

Access to 35+ banks and NBFCs

Lowest interest rates and customized offers

Doorstep documentation assistance

Fast approvals within 24–48 hours

100% transparent and trusted process